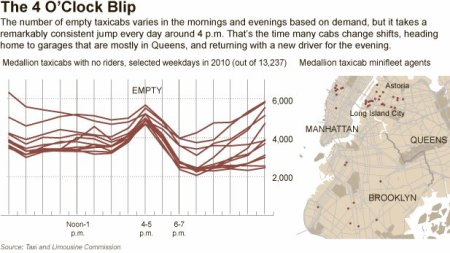

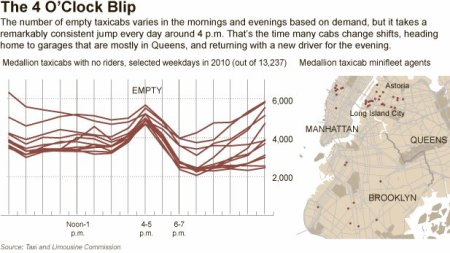

Apparently it is hard to find a taxi between 4 and 5pm in Manhattan. Why? Because that is the time when many taxis switch drivers. This turns out to be a fascinating capacity management issue.

The first surprise is that a substantial number of taxis are used around the clock in two 12-hour shifts. I guess NYC really does never sleep.

So, given that you have two 12-hour shifts, and clearly one driver can do only one of those shifts, you need to decide a time and place to switch drivers. The place turns out to be, in all likelihood, a garage in Queens. (The use to do it in Manhattan, but real estate became too expensive, so they moved to Queens.) The time, you would think, would be chosen at a relatively light period. Or, it would be chosen so that earning potential of the two shifts are equated in some sense (accounting for the fact, I would assume, that the day shift is more pleasant than the night shift). Take those factors into account and apparently 4 pm is a good time to swap drivers – one person gets the morning rush hour, one the evening rush hour. The result, according to NY Times 1/11/11 is a 4 O’Clock Blip of empty taxis:

What is really interesting about this is that the spike is so pronounced. If 20% of the taxis are taken out of service 4-5pm, then you would think that there would be a noticeable drop in competition. Wouldn’t more taxis want to make the switch at 3pm or 6pm to take advantage of this? In other words, why isn’t the blip smoother? Given that it is spiky, it must be that it is too costly to switch at the other times relative to the 4-5 pm slot.

What is really interesting about this is that the spike is so pronounced. If 20% of the taxis are taken out of service 4-5pm, then you would think that there would be a noticeable drop in competition. Wouldn’t more taxis want to make the switch at 3pm or 6pm to take advantage of this? In other words, why isn’t the blip smoother? Given that it is spiky, it must be that it is too costly to switch at the other times relative to the 4-5 pm slot.

One explanation has to do with coordination. If some cab drivers make the switch at 3, others at 4, others at 5 and yet others at 6, a cab driver needs to know when he will make his switch – when to drive the taxi back if he is doing the day shift and when to show up at the garage if he is doing the night shift. Keeping track of those times might lead to the inevitable late cabby, which will lead to idle taxis. Having everyone show up at 4-5 is a simple rule that is easy to remember – you show up at 4-5. When do you show up? 4-5. But this seems like it could be fixable with technology. A computer keeps track of the schedule and sends reminders to cabbys as to when they will show up. Or, it could be fixed with some consistent scheduling – for a given month a given cabby will have the same drop off/pick up time but the times are staggered to smooth the spike.

An alternative explanation could be due to demand. Maybe demand drops significantly at 4-5, so being a taxi at that time is not as advantageous as the lower supply would make it seem. This strikes me as unlikely, but what do I know about taxi demand in Manhattan between 4 and 5pm?

The Bloomberg administration is looking into this issue, being a data-driven type of administration. To their credit, they don’t plan to do anything until they identify the root causes. And even then, they say they are hesitant to tell businesses how to do their business – maybe the taxis know something that we don’t know. “Fixing” this issue (if it should be fixed) will not change the world much, but it is a fun capacity management exercise.

Posted by mswd

Posted by mswd