When it rains it pours – that is, sewage overflows into streams, rivers and lakes and then into our beaches and drinking water (yuck!). (NY Times 11/22/09) For example, cases of serious diarrhea at one Milwaukee hospital increase when local sewers overflowed.

The problem with our old sewage systems is that they are capable of handling normal “loads”, but when it rains, the demand on the system exceeds capacity. With no place to inventory the excess water, it is spilled into local waterways.

So what is the solution when peak demand exceeds capacity? The knee jerk reaction is to increase capacity. But this can be foolish – it can be very costly to increase capacity when it will be used only at peak demand times. A better strategy is to smooth out the demand peak. Of course, we can’t control rain, so that won’t work. But we can slow down the flow of rain into the sewage system by how we design our cities. In particular, planting trees helps to absorb the flow of water (maybe we can interpret this as an increase in capacity). Planting organic roofs can also slow down the flow of water – instead of rushing off the roof, it drips from the roof. Or, if we could design sewage systems so that rain water was processed in a different system than toilet water, then the peak demand problem is solved – peak rain water can be safely spilled into the river and it would be unlikely to have a coordinated demand peak of toilet water, i.e., separate smooth demand from the variable demand. (I never did believe the stories about the problems induced when too many people flush during a Super Bowl commercial.)

So what is the connection between sewage and holiday demand? Retailers face the peak demand problem in spades. The following graph plots sales of general merchandizers from 1992 to 2008 and clearly illustrates the annual holiday spike in demand

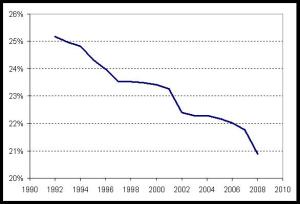

An interesting feature of this paper, contrary to what you hear in the press, is that the end-of-year spike is actually getting smoother. To illustrate, the following graph shows the % of annual demand that occurs in November and December:

From a peak of 25%, the fraction of annual sales occurring in November and December has been steadily declining, and now is about 21%. Why is this? It could be that consumers want to smooth their consumption (they can’t wait for that holiday present) or it could be that retailers are encouraging this demand smoothing (via pricing).

Another change in the data is the “back to school effect” – August’s sales relative to September’s sales has been showing a steady increase. Back-to-school is now the mini-Christmas of the year.

Posted by mswd

Posted by mswd

The following table provides a summary of the H1N1 vaccine forecasts and actual availability:

The following table provides a summary of the H1N1 vaccine forecasts and actual availability: