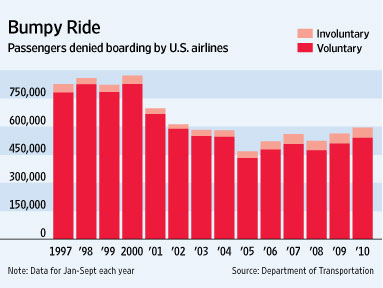

Overbooking a flight enables airlines to ensure that they fly with as much capacity as possible – given that 8-10% of passengers do not show up for a flight, you want to make sure that there are not too many empty seats on the plane. But if you overbook, you must be ready to find yourself in a situation in which you have more paid passengers than seats. Since sitting in the aisle is probably against FAA regulation, that means the airline might need to bump one or more passengers off of the flight. How should this be done?

The standard method is to offer a fixed benefit – say a $400 flight voucher – and hope that enough people take the deal. If that doesn’t work, the airline sweetens the deal. As a last resort they have to involuntarily bump a passenger (which costs them more).

According this WSJ 1/14/11 article, Delta has another idea – when passengers check-in, ask them how much they are willing to accept to be bumped from a flight (a $ amount) and choose the lowest bidding passengers if necessary. They have apparently be trying it out for one month.

This is an interesting idea. There are two obvious advantages: (i) it reduces the time and effort to solicit passengers off of a flight when you discover that you need to bump some people and (ii) it is hard to imagine that they would end up paying more to bump passengers. I suspect that passengers are willing to accept less cash to be bumped when they check in than when they are about to walk onto a plane – the cost of getting bumped is more tangible when you are watching the plane pull away from the gate. Furthermore, I think some passengers will bid less than the $200 or $400 that the airline would normally pay. (There are many ways to run this auction, but it seems that passengers receive their bids, rather than the highest clearing bid or the bid of the lowest non-bumped passenger.)

However, as an airline, do you want to ask every passenger to report how much they want to be paid if you fail to serve them? Imagine booking a vacation at a Four Seasons Resort and receiving an email like this: “We are excited that you will be staying with us and we look forward to catering to your every needs so that you will have a relaxing an memorable visit with us. On occasion, we are unable to accommodate all guests with reservations. If that were to occur, could you please let us know what the minimum cash you would accept to be booked into a partner hotel nearby to our facility?” It doesn’t scream customer service. But “customer service” may not be the first thought when people think of airlines these days. Air travel is a commodity and efficiency matters. I wonder if this experiment – like charging passengers for bags – will stick.

Posted by mswd

Posted by mswd